A bank reconciliation statement is generally defined as a statement or report created by businesses to match the bank transactions registered in the books of accounts along with the bank statement. The bank reconciliation can be performed to make sure that your different business transactions and expenses are reflected accurately in the company book.

You can accomplish the process of bank reconciliation by checking, comparing, and matching entries in your internal bank accounts along with bank transactions at your bank. Then to make the total available to finance managers you need to post the balances to your internal bank accounts. Bank reconciliation is furthermore considered a practical method to find and resolve any missing payments and bookkeeping errors.

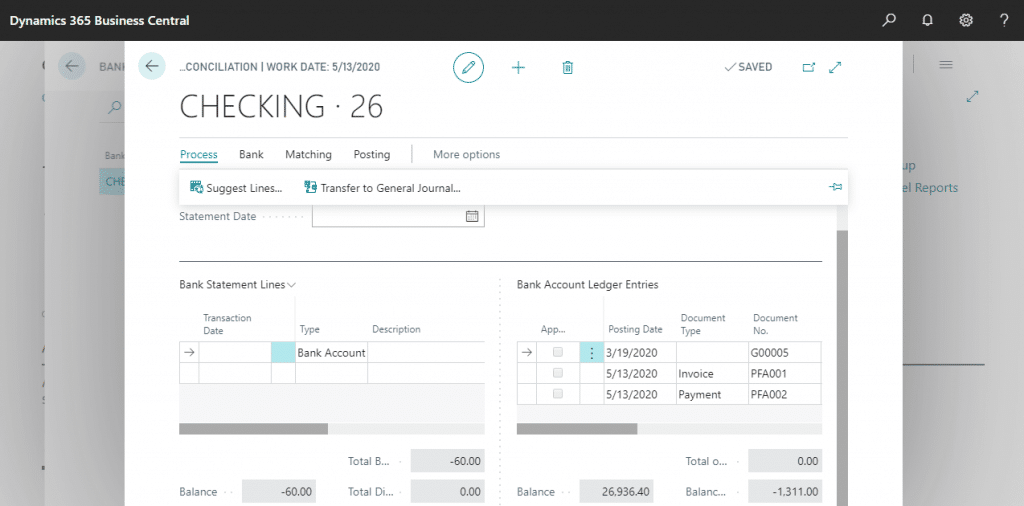

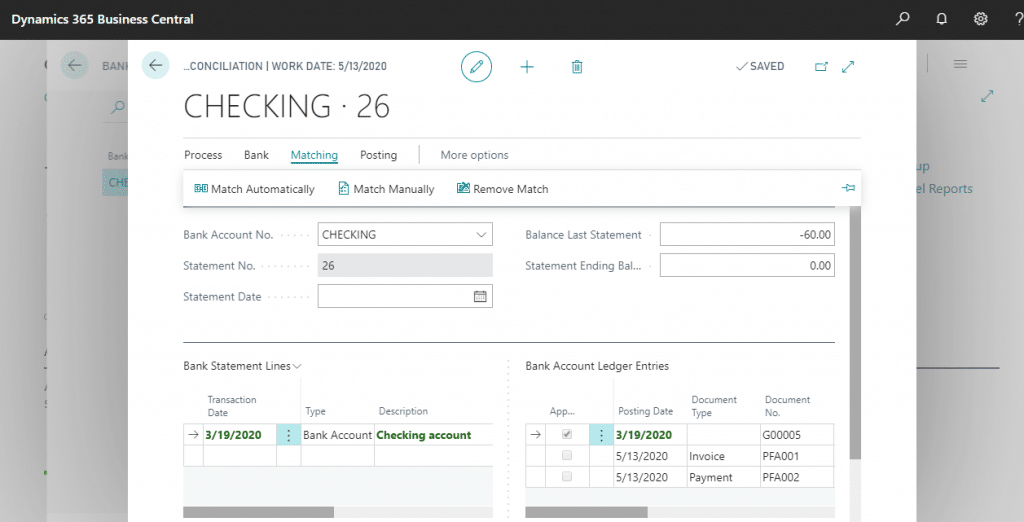

The lines on the Bank Account, the reconciliation pages are divided into two panes. The Bank Statement Lines Pane shows either imported bank transactions or ledger entries having outstanding payments. And the Bank Account Ledger Entries Pane displays the ledger entries in the internal bank account.

“Matching” is referred to the activity of reconciling bank transactions with internal bank entries. You can decide to perform matching automatically by utilizing the function – Match Automatically. Alternatively, you can manually select lines in both panes to link each bank statement line to one or more related bank account ledger entries and then use the function – Match Manually. And where entries match then the applied checkbox is selected on lines.

When the value in the “Balance to reconcile field in the Bank Account Ledger Entries page” equals the value in the “Total Balance field in the Bank Statement Lines pane”, you can choose the Post Action. Any non-matched bank account ledger entries will stay on the page, showing some discrepancy that you should determine and resolve to reconcile the bank account.

Also, read: Business Central Integration with LeafLink Cannabis CRM

To fill bank reconciliation lines with the help of importing a bank statement

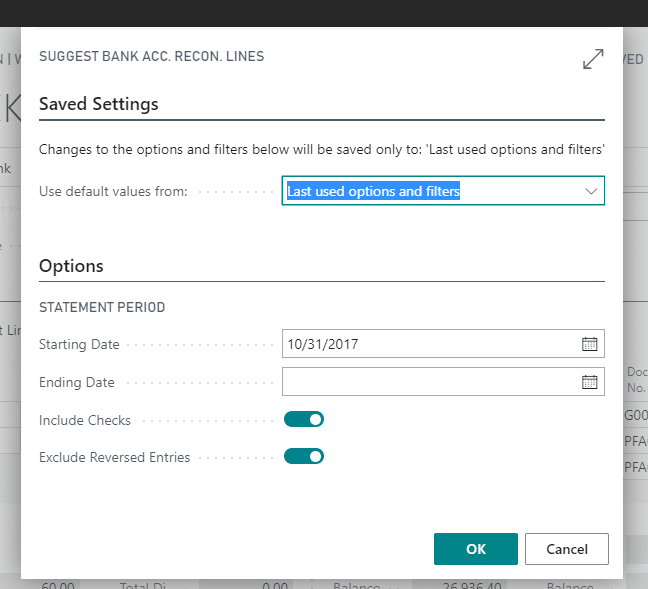

The Bank Statement Lines pane will be packed with bank transactions as per the stream provided by an imported file or the bank.

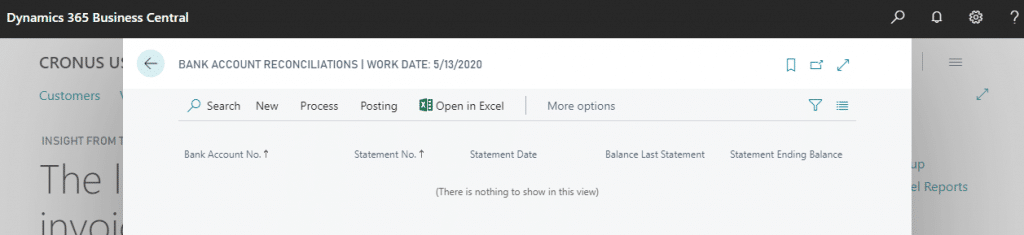

- Search Bank Account Reconciliation, and then select the related link.

- Choose the New action.

- In the Bank Account No. field, select the relevant bank account. The bank account ledger entries now appear in the Bank Account Ledger Entries Pane that earlier existed on the bank account.

- You need to enter the date of the statement from the bank in the Statement Date Field.

- Now, you need to enter the balance of the statement from the bank in the Statement Ending Balance Field.

- If you have a bank statement file, select the Import Bank Statement action.

Also, read: 5 Easy steps for sales return in Business Central

To match bank statement lines with bank account ledger entries automatically

Automatic matching functionality is provided by the Bank Account Reconciliation Page based on a matching of text on a bank statement line (left pane) with text on one or more bank account ledger entries (right pane). Note that you can overwrite the suggested automatic matching, and you can decide to not use automatic matching at all.

- On the Bank Acc. Reconciliation page, select the Match Automatically. This opens the Match Bank Entries Page.

- In the Transaction Date Tolerance (Days) field, you need to specify days before and after the bank account ledger entry posting date within which the function will search for matching transaction dates in the bank statement.

- Select the OK button.

- You need to choose the bank statement line, and then select the Remove Match action to remove a match.

Also, read: Payment Tolerance – Business Central user manual

To manually match bank statement lines with bank account ledger entries

- Choose a non-applied line in the Bank Statement Lines Pane on the Bank Acc. Reconciliation Page.

- Choose one or more bank accounts ledger entries in the Bank Account Ledger Entries Pane that can be matched with the selected bank statement line. Press and hold the Ctrl key to choose multiple lines.

- Select the Match Manually action.

- For all bank statement lines that are not matched, you need to repeat steps 1 through 3.

- You need to choose the bank statement line, and then select the Remove Match action to remove a match.

Also, read: How to Setup Intercompany Transactions in Business Central – The Ultimate Guide

To build missing ledger entries to match with the bank statement lines

Sometimes a bank statement includes amount for interest or fee charged. Such kinds of bank statement lines cannot be matched as there is exist no related ledger entries in Business Central. To create a related ledger entry that it can be matched with, you must then post a journal line for each transaction.

- On the Bank Acc. Reconciliation page, select the Transfer to General Journal action.

- On the Trans. Bank Rec. to Gen. Jnl. page, specify which general journal to use, and then select the OK button.

- Complete the journal line with the appropriate information, such as the balancing account.

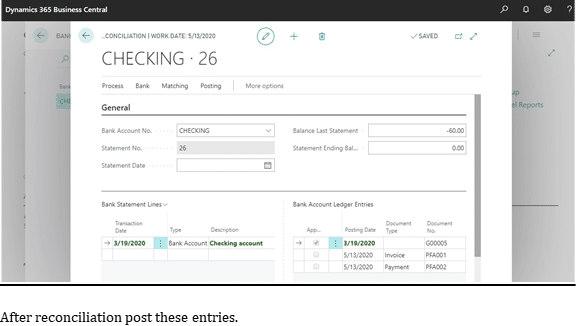

- To review the result of posting before you post, select the Test Report action. The Bank Account Statement report opens and displays the same fields as at the header of the Bank Account Reconciliation Page.

- Select the Post action.

- Refresh or reopen the Bank Acc. Reconciliation Page. Now, the new ledger entry appears in the Bank Account Ledger Entries Pane.

- You need to match the bank statement line with the bank account ledger entry.

You can see those entries in bank ledger entry.

Also, read: 4 Easy Steps to initiate Refund in Business Central

Conclusion

How often you reconcile bank statements depends on your volume of transactions. Businesses that have money entering and leaving their accounts multiple times every day, will reconcile every day.

The bank reconciliation process offers several benefits like:

- Detecting errors such as missed payments, double payments, calculation errors etc.

- Tracking and adding bank penalties and fees in the books

- Spot deceitful theft and transactions.

- Maintaining track of accounts payable and receivables of the business.

Microsoft Dynamics 365 Business Central

Microsoft Dynamics 365 Business Central is an all-in-one ERP business management solution that helps you connect your financials, sales, service, and operations to streamline business processes. Connect our team if you are interested in implementing Dynamics 366 business central in your business.