There might be circumstances when you want to write off the amount of an invoice. For example, if a consumer has underpaid and you do not want to leave the balance on the invoice. You can accomplish this by using payment tolerance. You can utilize payment tolerances so that each outstanding amount has a fixed maximum permitted payment tolerance. The payment amount is analysed when the payment tolerance is reached. Also, the outstanding amount is completely closed by the underpayment when the payment amount is an underpayment.

To prepare for no remaining amount on the applied invoice entry, a detailed ledger entry is posted to the payment entry. Whenever a payment amount is an overpayment, then a new detailed ledger entry is posted to the payment entry to make sure that no remaining amount is left on the payment entry.

You can utilize payment discount tolerances in the case if you accept a payment discount after the payment discount date, then it is always posted to either the payment tolerance account or a payment discount account.

Also, read: How to Setup Intercompany Transactions in Business Central – The Ultimate Guide

Payment Tolerance

If you currently pulling reports to manually review & process small dollar write-offs? These simple steps allow you to configure Dynamics 365 Business Central to automatically process small dollar write-offs to a bad debt or discount account when an invoice is nominally over or underpaid. Here’s how to leverage payment tolerance in Business Central.

Payment Tolerance Setup

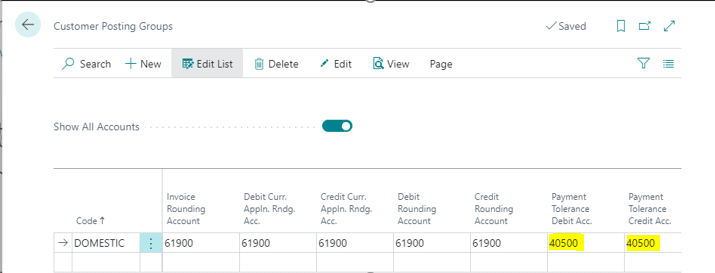

- To begin to leverage payment tolerances, you must first assign a G/L account for the small-dollar remainder of the customer invoice or payment.

- Search for customer posting groups by selecting the magnifying glass in the upper right-hand corner of the screen and choose the related link.

- Enter the desired G/L accounts to map payment tolerance debits and credits into your general ledger as appropriate.

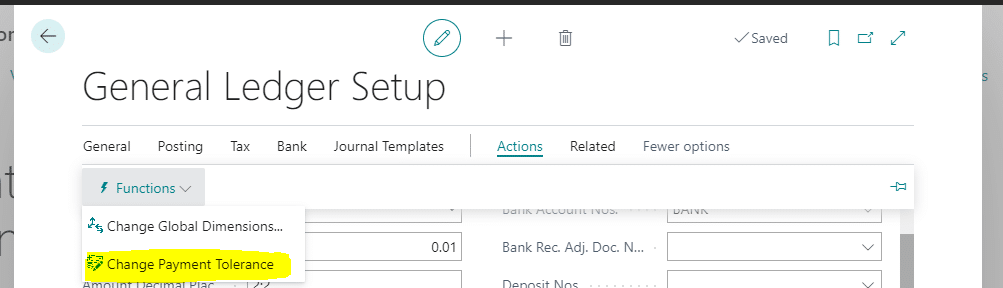

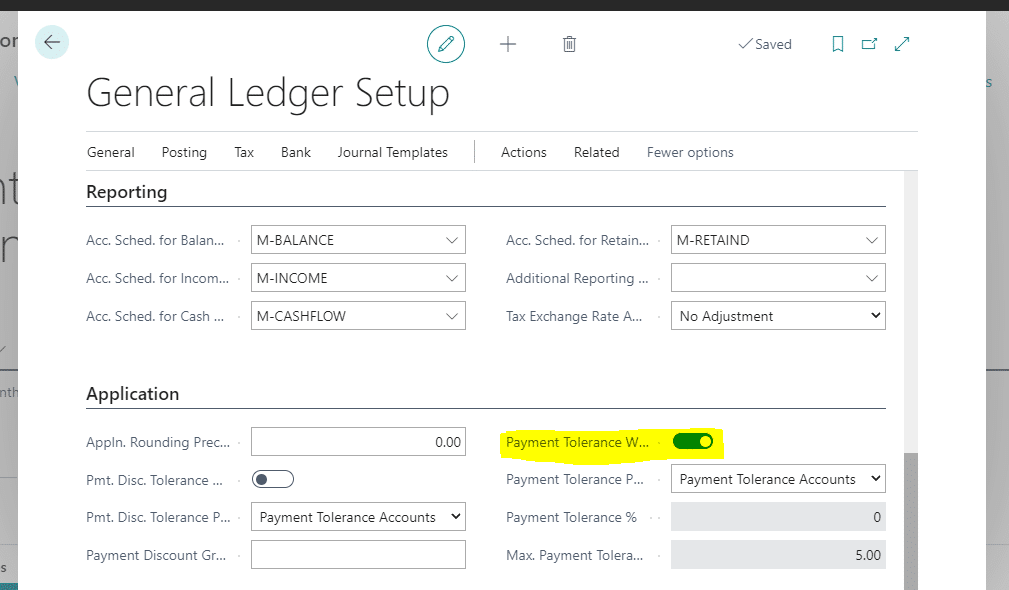

- Next, navigate to the general ledger setup to enter payment tolerance criteria. Search for the general ledger setup by selecting the magnifying glass in the upper right-hand corner of the screen and choose the related link.

Also, read: 4 Easy Steps to initiate Refund in Business Central

Payment Tolerance Setup

- Go to General Ledger Setup >> Actions >>Functions >>Change Payment Tolerance

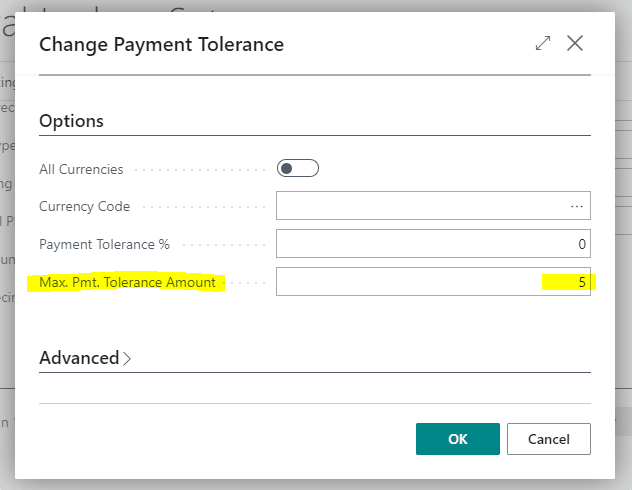

- Enter the parameters for your payment tolerance. In the example below, we want to write off remaining balances less than $5 for all currencies.

- In the application Fast Tab, you will see the parameters you have entered. If you wish to be alerted prior to executing on a payment tolerance, enable the Payment Tolerance Warning checkbox.

Also, read: PowerApps integration with Microsoft Dynamics 365 Business Central Online

Payment Tolerance Example

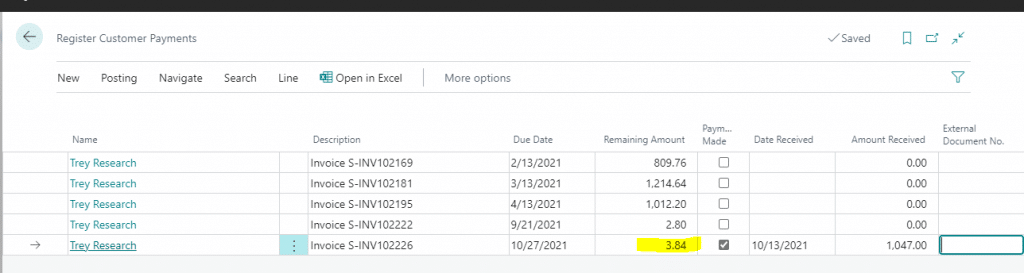

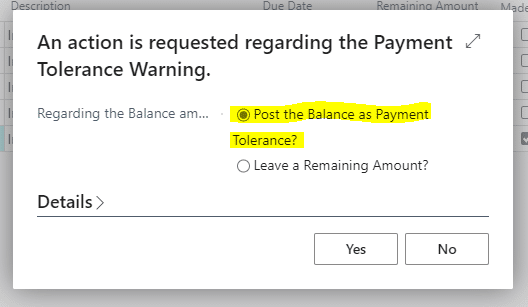

- In the example below, we are going to short pay the invoice by $3.84 and you will see the payment tolerance message box appear and the write-off happens.

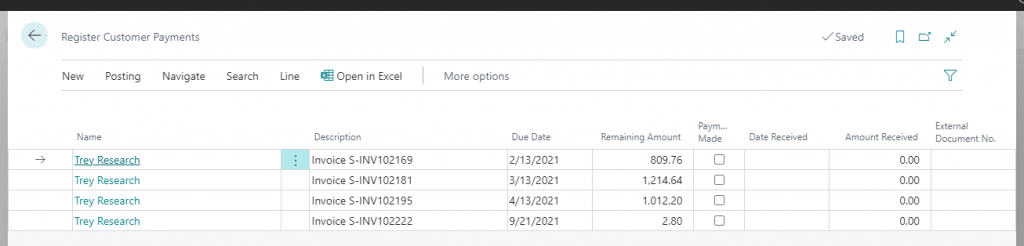

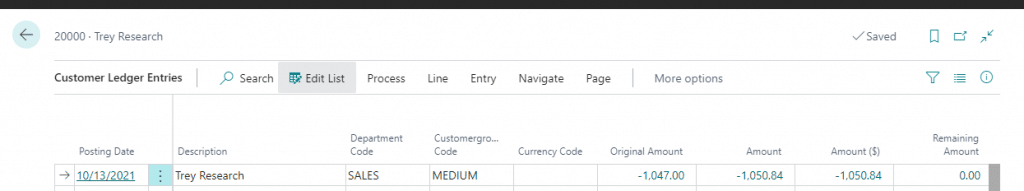

- Here you can see a payment transaction on a customer ledger. The original amount is $1050.84, and the amount is $1047.00. The difference of $3.84 was automatically recorded by our payment tolerance settings, and the invoice has been fully closed out.

- Screenshot Cust led entry

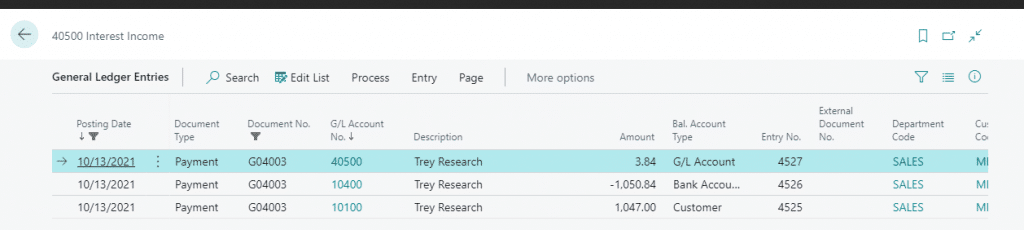

- A review of the general ledger shows the entry for the $3.84 into our mapped G/L account.

Once you’ve reviewed the business reasons behind an automated process, and agreed on a consistent standard, the configuration of Payment Tolerances within Business Central is quick & easy. Leveraging the Payment Tolerance functionality within Business Central is a great way to recognize the additional value the application can bring to your business!

*Access to configure this functionality is limited to users with the appropriate permissions.

Conclusion

If you are currently pulling reports to manually analyse and process small payments write-offs? Or you are spending an hour or longer every month on pennies? If so, then here is the alternative to save time in your month-end close process or monthly accounts receivable review. Defined above were simple steps that enable you to set up payment tolerance in Dynamics 365 Business Central to automatically process small payments write-offs to a discount account or bad debt when an invoice is nominally under or overpaid. Leverage the power of payment tolerance in Business Central today to make your payment process smoother and more manageable.

Microsoft Dynamics 365 Business Central

Microsoft Dynamics 365 Business Central is an all-in-one ERP business management solution that helps you connect your financials, sales, service, and operations to streamline business processes. Connect our team if you are interested in implementing Dynamics 366 business central in your business.