Why business is easier and better today?

In this century, we make orders online for almost everything such as hotel booking, meal ordering, cab ordering, flight booking, etc. Each of the above is carried out online via our mobile phones, computers, laptops, tablets, etc.

Most people prefer to shop online using their mobile phones, which in turn made mobile phones the largest gadget causing an interruption in the internet space.

Based on the research made by Demandware, about 45% of traffic and 25% of orders came from mobile phones by the end of 2017.

Mobile phones are not only gaining grounds presently, but they are also highly significant for our daily use. There are lots of mobile brands, with various products and services that they all possess such as the ability to contain apps that will aid the collection of payments from customers.

The world is evolving from standing at the front of the cashier to pay to goods or services to eCommerce and mCommerce. Rather than standing in a long queue to purchase something or book for anything, it can be done easily on your mobile phones.

Problem with Online transactions

As an app developer or an app vendor, it is important to take an important action which will help produce good revenue for you. The important action is that you do neglect the things you ought to consider carefully the integration of a standard payment gateway into your app,

Lots of times so many customers had to leave a purchase due to the problems they experience during the check-out time. This may be caused by a slow payment gateway which will slow down the processing of their mobile, feeling insecure about the privacy of their information in the payment gateway, limited payment options.

The success of an app is dependent on the satisfaction of the customers which is measured by how much they make use of the app and how much they refer the app to other people. While the dissatisfaction causes a huge failure for the app.

Also, read: Top tips to Build Secure Mobile Apps

Solution: Using Android apps as payment processors

Making payments is the most important step in completing the process of buying goods or services for a customer. Therefore apps must assure that the payment solution they will integrate will provide an uninterrupted and optimized payment process.

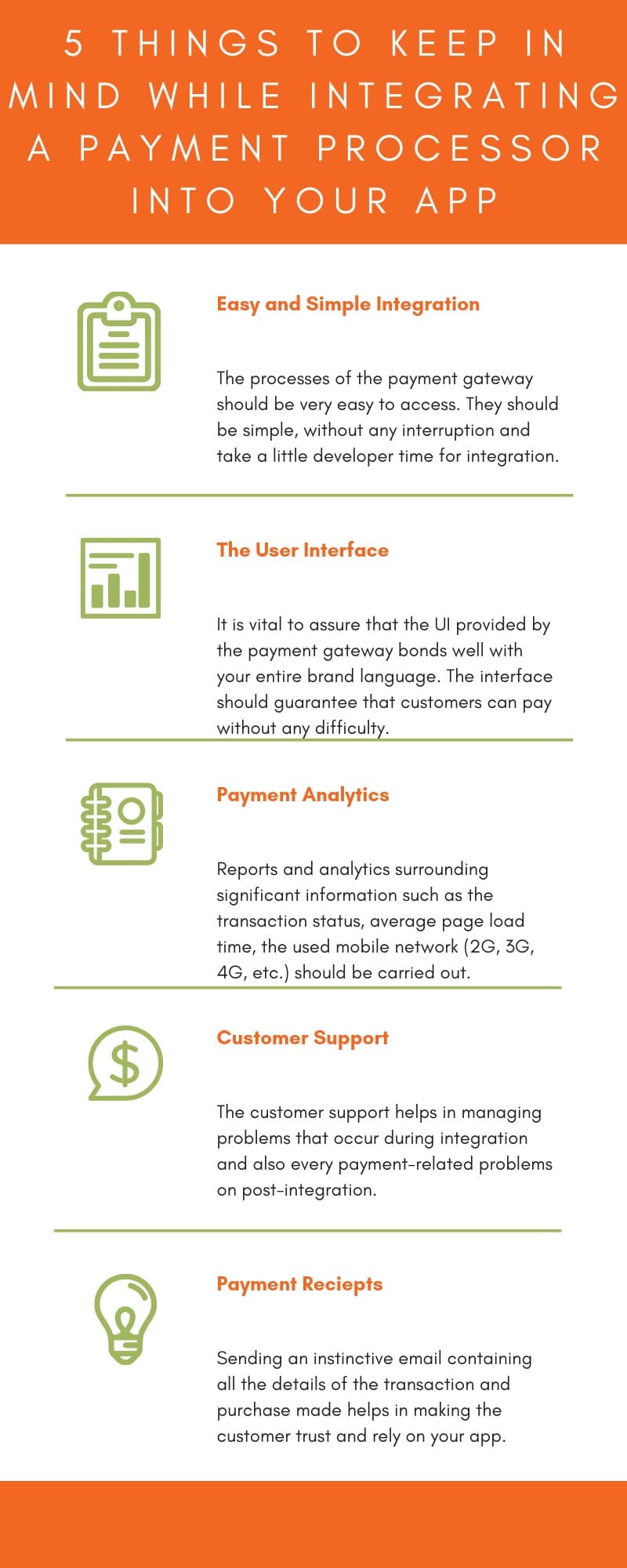

There are lots of things a mobile app needs to consider before integrating with a payment gateway such as fraud protection, analytics, intuitive UI, etc. Written below are the top 5 most important factors to consider:

1. Easy and Simple Integration

The processes of the payment gateway should be very easy to access. Developer SDKs must guarantee that the updates are handled without any difficulty by the business owners without making significant changes to the integration code. They should also be simple, without any interruption and take a little developer time for integration.

The size of the SDKs must be light which will enable it to fill up a little space on mobile phones, SDKs are needed in mobile phones because heavyweight apps that on the mobile phone space are likely to be deleted.

You must ensure that the SDK gives you adequate support for your required platform and framework when researching on payment gateway SDKs. Select a gateway that provides multi-platform and multi-framework support such as Android, React Native, iOS, Cordova, etc.

2. The User Interface

It is vital to assure that the UI provided by the payment gateway bonds well with your entire brand language. The interface should guarantee that customers can pay without any difficulty.

The payment gateway must ascertain that the bank pages are mobile-friendly and optimized. The processes of the payment must present the least number of steps to provide an uninterrupted payment experience.

3. Customer Support

While integrating with a payment gateway, you must consider customization. Currently, the most payment gateway provides customized checkouts that have both the colors and logo of your brand.

4. Payment Analytics

Online payments are usually affected by payment failures, double payments, refunds, dropoffs, etc; which is why it’s essential to consider the payment analytics.

Reports and analytics surrounding significant information such as the transaction status, average page load time, the used mobile network (2G, 3G, 4G, etc.) should be carried out. Also, the receipt of bank OTP must be controlled by the payment gateway and offered directly to the business owners.

It’s an important aspect to be considered because it reveals the main problems and enables apps to optimize the entire payment processes.

Lots of business owners usually look down on the customer support aspect when considering payment gateway. The customer support helps in managing problems that occur during integration and also every payment-related problem on post-integration.

The payment gateway must provide efficient customer support through phone calls, emails, social media, etc for every payment related inquiry within a short time.

5. Payment Receipts

Sending an instinctive email containing all the details of the transaction and purchase made helps in making the customer trust and rely on your app.

For the fact that the gateway has straightforward access to the status of the transaction made, it is suggested that the gateway sends out the confirmation email. The email receipts help in enhancing the brand connection for the business owner.

Also, read: Mastering the Mobile-First Strategy: Key Reasons Your Business Needs a Mobile-First Website in 2023

Top 5 Payment Gateways

1. Stripe

Stripe is a simple, secure and user- friendly payment gateway. The charge is standard with 2.9% plus 30¢ per card charge. It also provides discounts when the sum of the turnover of transactions has increased.

2. PayPal

It is the most popular payment gateway. It is filled with an abundance of vast functions. One of which is the split purchase transactions, reporting tools, easy invoicing and simple payment processes.

They charge 2.9% plus $0.30 per transaction without any hidden payment.

3. Amazon Payments

Amazon launched its payment gateway service long ago intending to provide the same payment standards on other sites.

The salesman or retailers using Amazon have a straightforward access to the personal and private shopping information of Amazon customers stored in their account. Their standard charge is 2.9% plus $0.30.

4. Aduyen

Aduyen is known worldwide significantly, it has answers for any size of the enterprise. The services are available with a bundle with a high-quality functionality —it supports all credit cards, possesses a secure payment procedure, it is being integration with CS-Cart/Multivendor, and also has total control of payments made on it.

5. Skrill

Skrill is known for its special simplicity and innovativeness. It provides payment services for quick checkouts and digital wallets. It has lots of benefits such as compounded documentation, fixed reporting functionality, plurilingual functionality, and tokenization.

Also, read: 10 reasons why B2B Apps are a Great Investment for Your Business

How to integrate a payment gateway in an Android application

- Just like that of iOS, use the Drop-in UI to connect the PGW with your Android device. Copy the piece of code inside your build Gradle file.

- Have a client token just like that of iOS. As soon as your app restarts your server will request for the client token, all you need to do is to copy and paste the code into your app.

- Show the Drop-in UI to start the collection of payment information; you may like to make use of your custom UI with the tokenization of the payment information.

- You can now test how effective the integration works, you might need a Braintree account here. But also remember to use the test card information because real numbers work only out of the sandbox.

- You can begin processing transactions by making use of the payment method occasionally. The processes are also the same as iOS.

Mobile App Development Services

Do you want to leverage mobile technology for your business? Cynoteck is a one-stop Mobile app Development Services provider. We provide iOS and Android application development services so that you can reach your target audience on any device.